Improve the profitability and financial health of your business with a Financial Exit Strategy

–so you can make more money while you still own the business and sell for top-dollar when you’re ready.

START NOW

Attracting potential buyers (and the best deals) for your business starts with knowing how to tell your business’ financial story.

Get everything you need to showcase your business in the best light with our 1:1 Financial Exit Strategy Sessions.

START NOW

If someone were to ask you…

When potential buyers take interest in your business, they will be looking for two things: your financial potential and any red flags in your company.

An in-depth Financial Exit Strategy guarantees that strong financials and smooth path to closing is all they find.

Most business owners rely on bookkeepers, accountants, CPAs, or software like QuickBooks to manage their financials.

While these are great to make sure there’s enough money in the bank and you’re never behind on your taxes…

They don’t offer any strategic or long-term planning advice - let alone suggestions on how to improve your business’ financials and increase its value.

Without strategic guidance, many business owners:

-

Aren’t able to explain how all your debts were used.

-

Don’t know which products or services are actually costing them money.

-

Don’t have the right systems to support their revenue growth.

-

Don’t understand your own financial statements (let alone know how to explain them to a potential buyer).

-

Have old, random entries in their books that don’t tie out, including that weird expense they didn’t know where to put.

-

Live on a constant financial rollercoaster, hoping there will be enough money to cover the bills from year to year (even as their business grows).

-

Pay more than they should on taxes, and miss out on strategies to plan how and when to pay taxes that they don’t even know about.

Before you get overwhelmed, please know you are not alone.

And taking control of the finances of your business is often much easier than it seems.

What if you could…

ALL OF THIS IS POSSIBLE.

You just need the right Financial Exit Strategy.

In our 1:1 Financial Exit Strategy Sessions, you will:

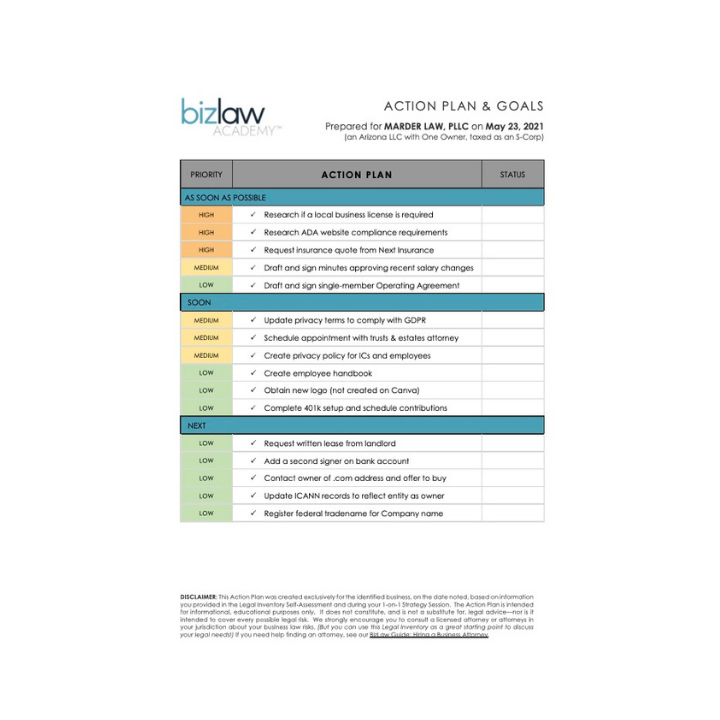

What’s included in a 1:1 Financial Exit Strategy Session:

Pre-Session Survey

to identify your legal priorities and goals, clarify your questions, and see where your business stands right now.

90min 1:1 Session

with David Kravec to get clear on what you want for your business’ future and create a roadmap that leads directly there

Custom Financial Exit Strategy & Action Plan

based on your specific business goals